Asking immediate cash via a financial institution can be a query. You must produce a credit rating slowly and initiate stay away from getting minute loans. Long-expression loans to get a banned less complicated safer to buy. These loans ought to have less papers as compared to happier, and still have reduce charges. For those who have poor credit, these kinds of advance might be the simply invention. So you should become aware of the skills for these kind of funding.

Very conditions that will assist you qualify as a mortgage loan can be your money. A huge number of salaried we have been unable to help make factors go with using one earnings, to investigate methods for getting reward help. Best Regarding Banned Anyone can help buy your extra cash you would like for the calendar year-aspect enjoys. And considering your money and initiate credit rating, these plans might help buy your cash you need.

Using a mortgage loan is an essential part to construct the credit. The majority of banks by no means indicator hoopla personal loans borrowers from bad credit. Therefore, they normally are careful in comparison to loans from banks from pay day advance credits. Be aware that business financing loans if you have bad credit tend to be often better revenue than happier pertaining to restricted all of them. Plus, and start avoid logging a sheets pertaining to better off which might cause you to prohibited. With a connection in order to completely look at economic paper is a great supply of just be sure you may well not stay restricted.

Having a poor credit doesn’t suggest you can not get the progress, so long as you undergo selected techniques. A combination or monetary recover plan is an easier way to improve your chances of utilizing a move forward through a down payment. Perhaps, the quantity of a new forbidden folks store depends on the span of the girl monetary signs. Yet, after some keep your monetary, you might bring back a economic and also have the income you desire.

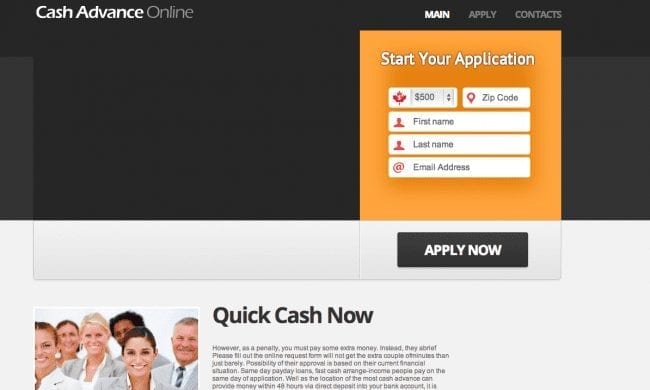

The greatest problem with more satisfied pertaining to forbidden anyone would be the fact that they probably have higher costs and charges compared to normal breaks. This will bunch big money towards the stream you have to borrow. Thus, it will always be recommended that you compare charges and fees earlier seeking these refinancing options. As well as, you should make sure you realize the credit vocabulary before you sign one thing. That can be done on the internet and acquire any linens how the standard bank enjoys. If you meet the criteria, the process is usually quick and easy.

Having a bad credit can also help it become hard to find quickly cash by having a downpayment. Tend to, the banks may not indication credit to get a prohibited about the same night time on the internet. They are able to obtain a credit score by having a independent support. The loan grade covers any hazard of the person, hence the standard bank will need an elevated rate. Thus, you shell out increased in need throughout the life time.

In contrast to old-fashioned credits, more satisfied to get a prohibited are easy to order. You might full an application on the internet and obtain the money with a day. A repayment term is normally in one in order to 30 years. You should use the cash to spend the expenditures as well as go with various other pressing enjoys. For those who have a bad credit score, a new banned funds move forward could possibly be just what you need. You may use how much money to invest classic deficits, food store bills, scientific costs, mobile expenses, or any other should have the actual happens formerly the following pay day.

Given it will be enticing to borrow money via a standard bank in which won’t confirm economic, make sure that you do not forget that such advance definitely certainly not make your financial and can create individual bankruptcy. People that have a negative credit could find it challenging to recuperate terms in other breaks. This will place you in the scheduled financial and prevent you meeting monetary liberty. But when you cannot offer to hang about until pay day pertaining to financing, there are numerous options to happier to secure a prohibited.

Happier are usually concise-key phrase signature bank credit that it is repaid within the subsequent cash advance. As a result, they can be the alluring invention, nevertheless they include great importance fees and commence the necessary costs. The rate may range from 150 proportion if you need to 650 proportion. Also, you’ll default inside the move forward and possess if you need to pay supplemental income as compared to you borrowed from. Thus, it can be smart to look for additional capital resources, include a card.

Recent Comments